In today’s fast-paced and digitally-driven world, accepting credit cards is no longer a luxury but a necessity for businesses. Whether you’re running a brick-and-mortar store or an online enterprise, the right payment terminal can enhance your business operations, streamline payment processes, and ultimately, elevate your brand’s credibility. So how do you choose the best credit card machine for your business?

It’s all about understanding your specific needs and aligning them with the features offered by different machines. Are you a small business owner who operates mostly out of a physical store? A countertop credit card machine might be your best bet. Or perhaps you’re always on the move, attending trade shows and pop-up events? Then, a mobile credit card reader could be the perfect fit. But it’s not only about the type of machine. You also need to consider transaction fees, reliability, customer support, and the machine’s compatibility with different credit card types. Let’s dive deeper into these aspects.

Introduction to Credit Card Machines for Businesses

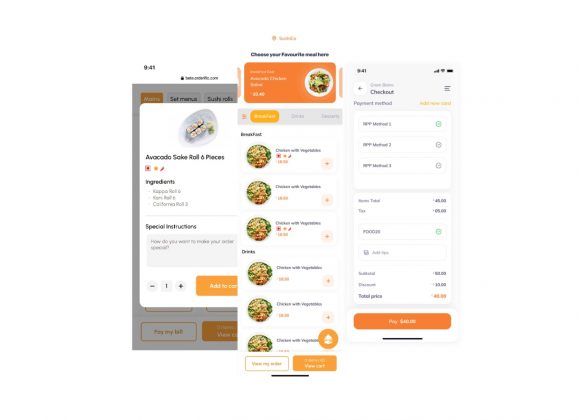

When it comes to business credit card machines, there are two main types: countertop and mobile. Countertop machines are dedicated devices that connect directly to your store’s phones or internet and require a power source for operation. They’re best suited for brick-and-mortar stores and provide a consistent level of service with reliable connection speeds. Mobile credit card readers, on the other hand, are battery-operated portable devices. These are ideal for businesses that move around a lot, such as food trucks or pop-up stores.

In addition to understanding the different machine types, you’ll need to consider the following aspects:

- Transaction fees: Different machines offer different fees for processing payments. Make sure you understand all the associated costs before committing to a machine.

- Reliability: You want a machine that is reliable and won’t cause you unexpected problems. Look for customer reviews or ask people in your network for their experience with different machines.

- Customer support: If something goes wrong, you want access to quick and reliable customer support. Read the fine print in the terms of service before committing to a machine.

- Compatibility: Make sure the machine you choose is compatible with all major credit card types, such as VISA and MasterCard.

Types of Credit Card Machines for Businesses

In this section, we’re going to break down the different types of credit card machines available for businesses. Understanding the nuances of each type can help you make an informed decision that fits your unique business needs. Remember, the right choice of equipment can significantly impact your customers’ buying experience and your bottom line. Let’s explore the variety of credit card machines that you can consider for your business.

Countertop Credit Card Machines

Countertop credit card machines are wired units that plug into phone and internet lines. They offer a reliable, high-speed connection with minimal time lag between order placement and payment processing. Many countertop machines come pre-installed with software to accept payments quickly and accurately. Some models also feature built-in EMV chip card readers for added security.

Mobile Credit Card Machines

Mobile credit card machines are the perfect solution for businesses that move around a lot. These portable devices connect wirelessly via Bluetooth or Wi-Fi and feature long-lasting batteries. Besides being lightweight and durable, mobile credit card readers also come with features such as EMV chip card readers and contactless payment acceptance. This makes them ideal for businesses with an on-the-go customer base.

Virtual Credit Card Machines

Virtual credit card machines are designed to offer a secure and cost-effective way of processing payments online. They provide merchants with the ability to accept credit cards from customers without the need for any additional hardware. Virtual payment solutions also come with features such as fraud protection, secure transactions, and multi-currency support.

Integrated Credit Card Machines

Integrated credit card machines are designed to streamline payment processing and checkout workflows. These systems typically integrate with point-of-sale or inventory management systems, allowing merchants to accept payments directly from the POS software. Many integrated credit card machines also come with EMV chip card readers for added security and convenience.

Features and Functions of Credit Card Machines

No matter which type of credit card machine you choose, there are certain features and functions that you should look for to ensure a smooth and secure payment process.

Payment Processing and Transaction Fees

Look for a credit card machine with low transaction fees and fast payment processing to maximize your profits. Many machines also come with the ability to accept payments from multiple types of credit cards, providing greater convenience to customers. Some payment processors may even offer discounts if you sign up for their services.

Security and Fraud Prevention Measures

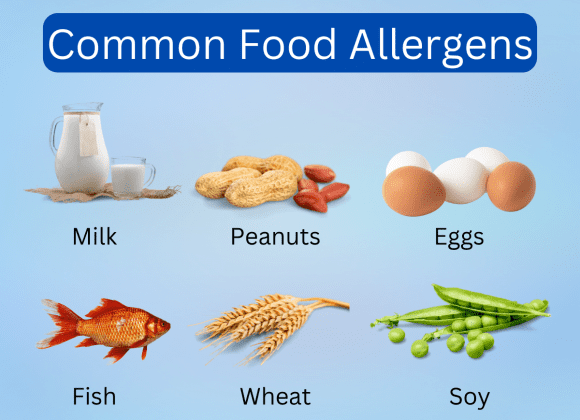

Security should always be a top priority when choosing a credit card machine. Look for features such as encrypted data transmissions, EMV chip readers, and fraud prevention measures to ensure that customer information is kept safe and secure. Many machines also come with PCI-DSS certification, which shows that they are compliant with security standards set by the major card networks.

Customer Service and Technical Support

When choosing a credit card machine, make sure to check the availability and quality of customer service and technical support. Many machines come with 24/7 live phone and chat support to ensure that you can get help whenever you need it. Some payment processors may also offer additional features such as online tutorials or onboarding assistance to help with setup and integration.

Additional Features and Add-Ons

Finally, consider the additional features and add-ons offered by different credit card machines. Some may come with advanced capabilities such as contactless payments, mobile integration, or cloud storage for customer information. These can all help you streamline your payment processes and provide a better buying experience to customers.

Choosing the Right Credit Card Machine for Your Business

Now that you understand the different types of credit card machines and their features, it’s time to narrow down your choices. To choose the right machine for your business, consider factors such as budget, space availability, customer needs, and the type of payment processing software you plan on using.

For instance, if you’re a small business owner who operates mainly from a physical store, then a countertop credit card machine might be the most cost-effective and convenient option. Or if you’re always on the move and need something lightweight and portable, then a mobile credit card reader could be the best choice.

Ultimately, it’s important to research different machines and payment providers to determine which one is right for your business. Don’t forget to consider transaction fees, reliability, customer support, and credit card types when making your decision. With the right setup, you can accept credit cards with ease and increase your profits in no time.

Common Issues and Challenges with Credit Card Machines

While credit card machines can be a great way to streamline payment processing, there are a few potential issues you should be aware of. For instance, it’s important to keep an eye on transaction fees and hidden costs as these can add up over time. Also, make sure that the machine you choose is compatible with the type of payment processor you plan on using.

Payment Processing Errors and Disputes

Payment processing errors and disputes can occur due to a variety of reasons, such as incorrect information or technical glitches. In such cases, it’s important to have a reliable customer service team that can help you resolve the issue quickly. Many payment processors also offer dispute resolution services so make sure to familiarize yourself with their policies beforehand.

Connectivity and Network Issues

Network and connectivity issues can occur with both countertop and mobile credit card machines. If you’re using a countertop machine, then make sure that the phone or internet lines are properly connected to ensure smooth payment processing. With mobile devices, always check the battery life before starting your shift. Furthermore, look for machines that offer built-in Wi-Fi or Bluetooth capabilities to avoid any connectivity issues.

Software and System Updates

Software and system updates are essential to ensure that your credit card machine is running optimally. Many machines may have built-in auto-update features, but it’s important to stay on top of the latest releases and patch any security weaknesses promptly. If you’re using a software payment processing provider, make sure that their system is regularly updated to support the latest features and security measures.

Compliance and Regulatory Requirements

Finally, don’t forget to consider any compliance and regulatory requirements when choosing a credit card machine. Depending on your location, you may need to adhere to specific laws and regulations that govern payment processing. Make sure to familiarize yourself with the relevant regulations before making your decision.

Conclusion

Choosing the right credit card machine for your business is essential to ensure smooth and secure payment processing. From countertops to mobile options, there are plenty of machines available on the market today. Before making your decision, consider factors such as budget, space availability, customer needs, and payment processor compatibility. Also be sure to look for features such as low transaction fees, EMV chip readers, and 24/7 customer service.

With the right setup, you can start accepting payments with ease and increase your profits in no time. So don’t wait any longer—start researching credit card machines today to find one that best suits your business needs! Good luck!

Find more informative and insightful content with Orderific here. For the many ways Orderific can improve your business, start trying it out here. It’s Orderific time now!

FAQs

What is a credit card machine and how does it work?

It is a device used to process payments which works by connecting to your store’s phone or internet line, allowing customers to pay for their purchases via debit or credit card.

What types of businesses need a credit card machine?

Any business that accepts credit or debit card payments will need a credit card machine.

What are the benefits of accepting credit card payments?

It can help to streamline your payment processes, increase customer convenience, and boost sales.

How much does a credit card machine cost?

The cost of a credit card machine will vary depending on the type and features you choose. Generally, countertop machines are more expensive than mobile options.

What are the different types of credit card machines available?

The main types of credit card machines are countertop, mobile, virtual, and integrated.

Can I use a credit card machine for online or virtual transactions?

Yes, you can use a virtual credit card reader to accept payments online.