Welcome to the world of financial clarity! If you’ve ever wondered, “How much is my business truly worth?” you’ve landed in the right place. We understand that navigating the complex world of company valuation can be daunting, but fear not! Company valuation calculator is designed to simplify this process for you and provide accurate insights into your business’s value.

By taking into consideration key factors such as cash flow, assets, liabilities, and market trends, calculator generates a reliable estimation of your business’s worth. Whether you’re considering selling, seeking investors, or merely want to understand your company’s financial health better, business valuation calculator is an invaluable tool. Step into the empowering world of informed business decisions with us. Let’s get started!

How Much is My Business Worth?

Before we dive into the nitty-gritty of company valuation calculator, let’s first understand what business valuation is. Simply put, it is the process of determining a company’s economic value. But why is it essential to know your business’s worth?

Firstly, understanding your company’s value can help you make strategic decisions that will drive future growth and profitability. Whether you’re planning to expand, enter into new markets, or make significant investments, having a clear understanding of your business’s financial standing is crucial.

Additionally, if you’re considering selling your business or looking for investors, knowing its value will help you negotiate better deals and attract potential buyers or investors. It also gives you a solid foundation for justifying your asking price.

Using This Business Valuation Calculator

Now that you understand why business valuation is essential, let’s explore how calculator works. Step-by-step process makes it easy for you to use, even if you’re not a financial expert.

About Your Inputs

To generate accurate results, our calculator requires you to input specific financial data. Some of the key inputs include:

- Cash Flow: This is the money flowing in and out of your business during a particular period.

- Assets: These are tangible and intangible items owned by your company, such as property, equipment, patents, and trademarks.

- Liabilities: These are debts and financial obligations that your company owes to others.

- Market Trends: Our calculator also considers the current market conditions and trends in your industry to provide a well-rounded valuation.

About Your Results

Based on your input, company valuation calculator will provide you with an estimated value of your business. Keep in mind that this is only an estimation and may vary depending on various factors.

Also consider a detailed breakdown of the results, helping you gain a better understanding of how we arrived at the final figure. This includes insights into how each input impacts the overall valuation.

How Do You Calculate the Value of a Business?

There are several methods to calculate the value of a business, and company valuation calculator incorporates some of the most reliable and widely recognized techniques. One common method is the ‘Income Approach,’ which is based on the idea that a business’s value lies in its ability to generate future cash flows. This approach focuses primarily on the company’s cash flow and takes into consideration the risks associated with future earnings.

Another method incorporated in calculator is the ‘Market Approach.’ This method compares your business to similar businesses in the market. It relies heavily on industry trends and market transactions, which helps provide a realistic valuation. Both these approaches, when used together, provide a comprehensive and accurate view of your business’s worth. These evaluation methods enable in any calculator to deliver a realistic and straightforward assessment of your company’s value.

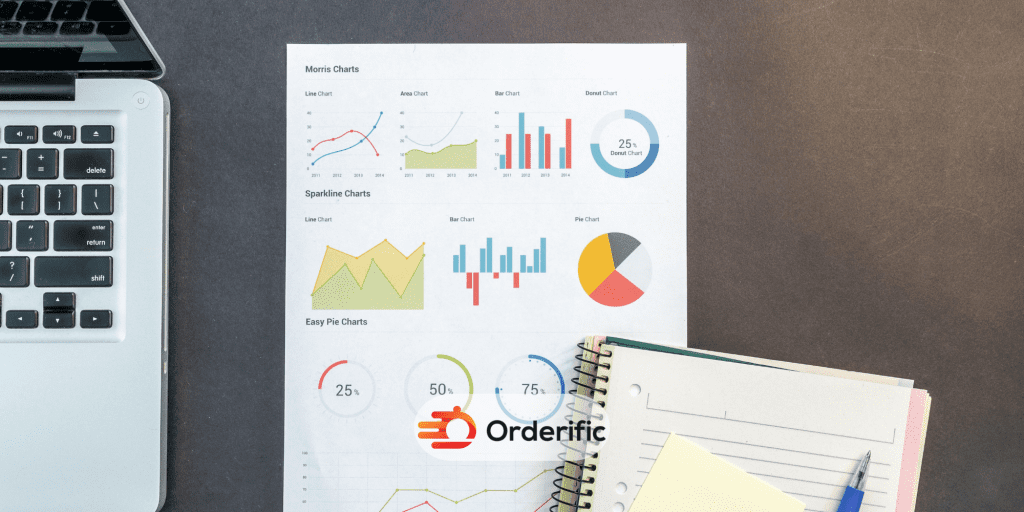

Four Common Business Valuation Methods

Let’s delve deeper into some common business valuation methods. The first method we have is the Asset-based Approach. This method calculates a business’s total worth by adding up all its assets. It subtracts the total liabilities from this amount to arrive at a final value. It’s especially useful for companies with significant tangible assets, like real estate companies or manufacturing firms.

Next, the Earnings Multiplier Method. This method bases the company’s value on its ability to produce wealth in the future. It adjusts the current earnings of the business based on an industry multiplier, which can offer an estimate of the company’s future financial performance. This method is particularly useful for service-based or high-growth companies, where assets don’t paint the full picture.

Conclusion

Understanding your business’s worth is a vital aspect of strategic planning and decision-making. Company Valuation Calculator is designed to offer you a reliable estimate of your company’s value, utilizing key methodologies used by financial experts. By examining key parameters such as cash flow, assets, liabilities, and market trends, you can gain invaluable insight into your business’s current standing.

Always remember, that the road to financial clarity begins with an accurate valuation of your company. With this tool at your disposal, you’re now equipped to step forward with confidence. Whether you’re planning to sell, seek investments, or expand your business, having an accurate estimation of your business’s worth will always steer you in the right direction. Let’s embrace the world of informed business decisions together.

You can find more informative content with Orderific here. For the countless benefits Orderific can bring to your business, start trying it out here. Today is Orderific time!

FAQs

How does a company valuation calculator work?

A company valuation calculator uses various financial inputs such as cash flow, assets, liabilities, and market trends to determine an estimated value for a business.

What information do I need to input for the calculation?

To generate accurate results, our calculator requires you to input specific financial data such as cash flow, assets, liabilities, and market trends.

Can a company valuation calculator be used for any business?

Yes, the company valuation calculator is designed to provide estimates for businesses of all sizes and industries.

Is the valuation provided by the calculator accurate?

Our calculator uses reliable valuation methodologies based on industry standards. However, please keep in mind that this is only an estimation and may vary depending on various factors.

What factors can affect the valuation of a business?

Several factors can affect the valuation of a business, including its cash flow, assets, and liabilities, as well as current market conditions and trends in the industry.