Introduction

Welcome to a comprehensive guide to navigating the landscape of West Virginia’s minimum wage standards. Here, you’ll find crucial information about the West Virginia minimum wage, the federal minimum wage, and how these standards impact employers and employees. As we delve into the intricacies of labor law, including hour law and the Fair Labor Standards Act, we’ll keep in mind the importance of living wage for West Virginia workers.

Understanding wage standards is vital to ensuring fair compensation for every hour employees work in West Virginia. Stay tuned to learn about unique aspects of West Virginia labor law, such as the regulations for tipped workers and overtime pay. We’ll also discuss the impact of minimum wage increases at the state and federal levels.

Understanding West Virginia Minimum Wage

In West Virginia, minimum wage is a critical point of discussion for both employees and employers. Established by federal and state labor laws, it sets the introductory wage rate an employer must pay to their workers. The current West Virginia minimum wage is determined by the West Virginia Department of Labor and is adjusted periodically.

Understanding the intricacies of the West Virginia minimum wage is crucial for employers to ensure they are fully compliant with state laws. It’s also essential for workers to be entitled to a specific hourly wage for the hours worked.

The Fair Labor Standards Act (FLSA) sets the federal minimum wage, and the state of West Virginia must comply with these regulations. However, if the state minimum wage is higher, employers must pay the higher rate. Tipped workers, such as restaurant servers and bartenders, also have specific wage regulations defined by West Virginia state and federal laws.

The West Virginia labor law stipulates overtime pay for hours worked over 40 hours in a work week. This means that West Virginia employers should be aware of these overtime rules to avoid running afoul of labor law and risking unpaid wages for their employees.

Significant conversations are happening around the minimum wage increase at the state and federal levels. Wage hikes are viewed as a path to a living wage for many employees, enabling a better standard of living for West Virginians.

Navigating Wage Standards

1. Determining The Current West Virginia Minimum Wage

The current West Virginia minimum wage is pivotal to understanding the state’s wage standards. The West Virginia Department of Labor sets this rate and is subject to periodic changes to account for shifts in the cost of living and economic conditions. The most updated rate is an essential piece of information for both employers and employees. Employers need to ensure they’re meeting their legal obligations and paying their staff fairly, while employees must stay informed to know their rights and confirm they’re receiving lawful compensation.

When comparing the West Virginia minimum wage with the federal minimum wage, the higher of the two prevails. This means employers must pay their employees at the higher state rate if the West Virginia minimum wage exceeds the federal minimum. This comparison is something both employers and employees should keep in mind to ensure compliance with all labor laws. The value of keeping informed cannot be overstated, as it aids in fostering a fair and equitable work environment for all.

2. Minimum Wage Increases And Adjustments

Adjustments to the minimum wage are a significant part of wage standards, as they redefine the baseline compensation for workers. Periodic updates in the West Virginia minimum wage are made to reflect changes in the cost of living and other economic factors. These adjustments are crucial for employees, as they can significantly affect their standard of living and financial stability. Employers should also be aware of these changes to ensure their compliance with updated wage standards and to adjust their payroll accordingly. It’s important to note that these wage increases are not arbitrary. They are the result of careful considerations made by the West Virginia Department of Labor, taking into account various economic indicators and labor statistics. These increases are designed to balance the needs of the workers and the economic sustainability of the businesses.

3. Tipped Employees And Minimum Wage

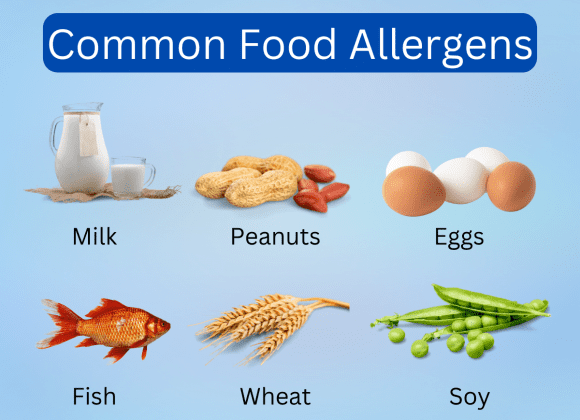

In West Virginia, just like in many other states, minimum wage laws for tipped employees differ from those of non-tipped workers. A “tipped employee” is typically defined as any worker who regularly receives more than $30 per month in tips. Such tips can lower the actual wage employers are legally required to pay, down to a certain limit. However, the overall earnings of tipped employees, including tips and wage, should always meet or exceed the federal minimum wage.

This aspect of the West Virginia labor law often becomes a point of contention as tipped workers, such as restaurant servers and bartenders, rely heavily on tips to supplement their income. For employers, understanding these parameters is pivotal to ensure business practices align with both federal and state wage regulations.

The Fair Labor Standards Act (FLSA) also addresses the wage requirements for tipped employees. Here, the application of the “tip credit” comes into play, which allows employers to take a credit against its minimum wage obligation for tipped employees equal to the difference between the required cash wage and the federal minimum wage.

Implications For Workers And Employers

1. Impact On Workers’ Livelihoods

The West Virginia minimum wage significantly impacts the livelihoods of workers. A sufficient minimum wage ensures that workers can afford basic necessities such as food, housing, and healthcare. Changes in the minimum wage directly impact their financial stability and overall quality of life. Therefore, it’s crucial for workers to stay informed about updates to wage standards, as these changes could substantially influence their income and cost of living. For low-wage workers, a wage increase could mean the difference between living paycheck-to-paycheck or attaining a more comfortable standard of living. It’s essential to understand these implications in order to fully grasp the importance of the West Virginia minimum wage in the broader context of economic stability and workers’ rights.

2. Balancing Business Costs And Fair Compensation

For businesses, striking a balance between minimising operational costs and offering fair compensation is often a challenging task. The adjustments to the West Virginia minimum wage have direct implications for the overall payroll expenses for employers. While higher wages can lead to increased employee satisfaction and productivity, they also elevate operating costs. Therefore, employers must remain updated about wage standard changes to plan their business strategies effectively. Similarly, prospective changes to the minimum wage may demand business adjustments, such as price alterations, to offset increased labor costs. Understanding these implications is vital for maintaining sustainable and responsible business practices in West Virginia.

3. Compliance And Legal Considerations

Compliance with wage standards goes beyond just ethical business practices; it’s a legal necessity. Employers who fail to comply with the West Virginia minimum wage regulations risk legal repercussions, which can include penalties and damage to their reputation. Staying informed about the most recent wage standards, and ensuring adherence to them, is essential not only for business continuity but also for establishing fair and respectful working conditions. On the other hand, employees should be aware of their rights and the current wage standards to ensure they receive fair compensation for their work. In essence, understanding and adhering to West Virginia’s minimum wage standards is a shared responsibility that aids in promoting an equitable workforce and a prosperous state economy.

Future Trends And Outlook

1. Potential Changes In West Virginia Minimum Wage

Changes in the West Virginia minimum wage are inevitable due to the dynamic nature of the economy. These adjustments, driven by factors such as inflation, changes in the cost of living, and political decisions, should be closely monitored by both employers and employees. The potential increase in the minimum wage may lead to improved living standards for workers, while simultaneously, it could result in increased operational costs for businesses. It’s a balance that involves ensuring fair compensation for work and maintaining economic sustainability. Therefore, staying informed and agile in response to these changes is essential for navigating the future landscape of the West Virginia minimum wage.

2. National And Statewide Economic Factors

National and statewide economic factors play a substantial role in determining the West Virginia minimum wage. Economic indicators, such as inflation rates, unemployment rates, and cost of living indices, all contribute to the adjustments made to the minimum wage. For instance, a rise in the cost of living might necessitate an increase in the minimum wage to ensure workers can afford basic necessities. Conversely, a high unemployment rate might discourage an increase in the minimum wage, as it could potentially lead to job losses. Understanding these economic conditions and their implications on wage standards is vital for both employers, who need to plan their business finances, and employees, who depend on these wages for their livelihood.

3. Advocacy And Discussions Surrounding Minimum Wage

Advocacy and discussions surrounding the minimum wage are shaping the future wage standards both at the state and federal levels. Groups advocating for a living wage believe that a higher minimum wage could improve the standard of living for many workers, reducing poverty and income inequality. On the other hand, some business groups and economists argue that a significant increase in the minimum wage could lead to job losses and higher prices for consumers. Understanding these ongoing discussions and their potential impact on the West Virginia minimum wage is crucial for workers and employers alike. Staying informed about these debates helps individuals and businesses to anticipate potential changes and adjust accordingly.

Conclusion

In essence, understanding the West Virginia minimum wage is far more than a legal necessity; it’s a critical component of economic stability, fair business practices, and improved living conditions for workers. The minimum wage landscape is ever-changing, influenced by a multitude of factors such as cost of living, labor statistics, and nationwide economic conditions. It’s imperative for both employers and employees to stay informed on these regulations, which can have profound implications for their livelihoods and business operations. As discussions continue at the state and federal levels, the future of the West Virginia minimum wage remains a topic of high relevance for all stakeholders.

For further assistance on these matters, Orderific, a trusted name in business solutions, offers tailored guidance and tools to help businesses navigate these complexities. To see how Orderific can streamline your business operations and ensure compliance with wage standards, Book a demo with us today.

FAQs

What is the minimum wage in West Virginia?

The minimum wage in West Virginia is $8.75 per hour.

Are there any exemptions to the minimum wage requirements in West Virginia?

Yes, certain workers like tipped employees, full-time students, and workers with disabilities may be exempted.

Is there a separate minimum wage for tipped employees in West Virginia?

Yes, tipped employees have a lower cash wage, but their combined tips and wage should meet or exceed the federal minimum wage.

What should employers do to ensure compliance with West Virginia’s minimum wage laws?

Employers should stay informed about current wage standards, ensure their payroll aligns with these laws, and regularly check for any changes in the minimum wage.

Are there any pending changes or discussions regarding West Virginia’s minimum wage?

Yes, there are ongoing discussions about raising the minimum wage.