Introduction

Understanding the intricacies of employee pay, particularly the minimum wage, is crucial for both employees and employers. In Massachusetts, the minimum wage rate, regulated by Massachusetts law. It is enforced by the Fair Labor Division of the Massachusetts Department of Attorney General. Which is distinct from the federal minimum wage. Knowledge of the Massachusetts minimum wage is essential. Not just for Massachusetts workers but also for those in neighboring New England states like New Hampshire, as pay rates and laws may differ.

Employment law, including the Fair Labor Standards Act, governs wage practices. Ensuring that employers nationwide adhere to certain wage standards, including for tipped employees. These laws include provisions for hour laws, ensuring employees are paid fairly for each hour worked. Under the Massachusetts minimum wage law, tipped workers are also guaranteed a certain base wage, supplementing their tips.

The minimum wage in the Bay State, often higher than in many states. It has implications for employees and employers across the Greater Boston area and beyond. It’s essential to stay updated on any potential minimum wage increases announced by the Massachusetts Department. Understanding these regulations helps maintain fair labor standards and leads to a healthier, more equitable working environment.

Current Minimum Wage In Massachusetts

As of 2021, the Massachusetts minimum wage stood significantly higher than the federal minimum wage. This wage, set by Massachusetts law and regulated by the Fair Labor Division. Ensures that workers in the Bay State earn a living wage. It is a result of consistent effort towards higher minimum wage than most states, including New Hampshire and NY.

This state minimum wage applies to all employees, including tipped employees. According to the Massachusetts minimum wage law, tipped workers are guaranteed a specific base wage in addition to their tips. This rate has implications not just for workers, but also for employers in Massachusetts, especially in the Greater Boston area.

Understanding the Massachusetts minimum wage is crucial. As it is subject to change based on minimum wage increases announced by the Massachusetts Department. Additionally, it is critical to consider the Fair Labor Standards Act and hour laws. Which ensure that employees are paid appropriately for every hour worked.

Knowing minimum wage in Massachusetts, how it compares to federal minimum wage, is important for all workers in New England. It helps maintain fair labor standards and creates a healthier work environment. This understanding is also essential to employers to ensure they are compliant with all regulations of the Massachusetts Fair Labor Division and the United States Attorney General, particularly when it comes to paying family members who are employees.

Minimum Wage Increase In Massachusetts

The Massachusetts Department and Massachusetts law govern the steady increases of the Massachusetts minimum wage. This aims to ensure that employees in the Bay State, New Hampshire, and beyond are fairly compensated. The Massachusetts minimum wage is notably higher than the federal minimum wage. It also exceeds that of neighboring states like New York.

The Massachusetts minimum wage law, along with the Fair Labor Standards Act. Plays a pivotal role in ensuring employers pay employees fairly for every hour worked. This includes tipped employees who receive a set base wage in addition to their tips. Fair labor standards and hour laws are vital for maintaining a healthy, equitable work environment and ensuring that Massachusetts workers, whether in Greater Boston or New England, are appropriately paid.

Employers in Massachusetts, under the watch of the Fair Labor Division and the United States Attorney General, have an obligation to comply with these regulations, particularly when it comes to paying family members who are employees. These wage regulations have implications beyond just workers, affecting employers and shaping labor standards across the state. Staying updated with any minimum wage increases helps create a more equitable and fair workforce in Massachusetts, ensuring all employees, including tipped workers, earn a living wage.

Tipped Employee Minimum Wage In Massachusetts

In Massachusetts, the minimum wage is a critical aspect of employment law, particularly for tipped employees. The Massachusetts minimum wage law, under the umbrella of the Fair Labor Standards Act, stipulates that tipped employees are entitled to a base wage in addition to their tips. This base wage is part of the state minimum wage and is higher than the federal minimum wage.

For tipped employees in Massachusetts, this wage structure ensures they earn a decent living wage, even if their tips fall short for a particular hour. This minimum wage rate is consistently reviewed by the Massachusetts Department and the Fair Labor Division, in line with the Massachusetts law.

As part of this commitment, Massachusetts law has provisions for a minimum wage increase, ensuring the state’s minimum wage remains competitive and fair. Understanding the Massachusetts minimum wage and the specifics of the wage law for tipped workers is vital for all employees, particularly those in service industries. In turn, employers ensure they are within the regulations of the Fair Labor Division and the United States Attorney General. This understanding helps to maintain a balanced and fair working environment in the Bay State, encouraging a healthier, more equitable workforce. Future minimum wage increases will continue to shape labor standards for both employers and employees in the state.

Exemptions To The Minimum Wage In Massachusetts

- There are certain exemptions to the Massachusetts minimum wage, which are carefully outlined and regulated by the Massachusetts Department and Massachusetts law. These exceptions aim to ensure fairness and compliance with the wage structure under the Fair Labor Standards Act, which is specifically designed to safeguard employees’ rights and ensure they earn a living wage in Massachusetts.

- Tipped employees, for example, receive a base wage in addition to their earned tips, providing them with additional income opportunities. Moreover, it’s important to note that Massachusetts minimum wage law sets a higher minimum wage compared to the federal minimum wage, demonstrating the state’s commitment to fair compensation for workers.

- In fact, Massachusetts minimum wage surpasses that of neighboring states such as New Hampshire and New York, further emphasizing the state’s dedication to ensuring workers’ well-being. Employers play a crucial role in adhering to these wage laws, as violations may result in potential repercussions from both the Fair Labor Division and the United States Attorney General’s office.

- Looking ahead, future increases in the Massachusetts minimum wage are anticipated, reflecting ongoing efforts to address the cost of living and provide employees with reasonable compensation. By continually evaluating and adjusting the minimum wage, Massachusetts strives to maintain a fair and equitable work environment for all its workers.

How To File A Wage Complaint In Massachusetts

- Start by discussing the issue with your employer to see if it can be resolved informally. Sometimes, there may be a simple misunderstanding or miscommunication that can be resolved through open dialogue.

- If the issue persists, file a wage complaint with the Fair Labor Division of the Massachusetts Department of Attorney General. This division is responsible for enforcing wage and hour laws in the state, and they are there to help ensure that workers receive the pay they are entitled to.

- When filing a wage complaint, provide detailed information such as your name, contact information, employer’s name and address, time period of the complaint, and any relevant documentation. This will help the Fair Labor Division to better understand and investigate your case.

- The Fair Labor Division will review your complaint and may conduct an investigation if necessary. They have the authority to interview both you and your employer, and they may request additional documentation or evidence to support your claim.

- It’s important to know that all parties involved are protected by law from retaliation. This means that your employer cannot take any negative actions against you for filing a wage complaint. If you experience any form of retaliation, you should report it to the Fair Labor Division immediately.

- Massachusetts takes wage complaints seriously and is committed to upholding fair labor standards. The state has laws in place to protect workers and ensure that they are paid fairly for their work. By filing a wage complaint, you are not only standing up for your own rights, but also helping to maintain a fair working environment for all workers.

- It’s crucial to understand the Massachusetts minimum wage law and your rights as a worker. Familiarize yourself with the specific provisions of the law, including minimum wage rates, overtime requirements, and other aspects.

Conclusion

In conclusion, the Massachusetts minimum wage, higher than the federal minimum wage. It is a testament to the state’s commitment to upholding fair labor standards and creating a balanced and equitable workforce. This rate, regulated by Massachusetts law and the Fair Labor Division. It applies to all employees, including tipped workers. It is subject to regular increases to ensure that employees earn a competitive wage. Understanding these laws is paramount for both employees and employers. As it ensures compliance and contributes to a healthier work environment.

For any wage-related concerns or violations, the Fair Labor Division of the Massachusetts Department of Attorney General is ready to investigate and enforce these laws. Employees are urged to file a wage complaint should they find their employer not adhering to Massachusetts minimum wage law.

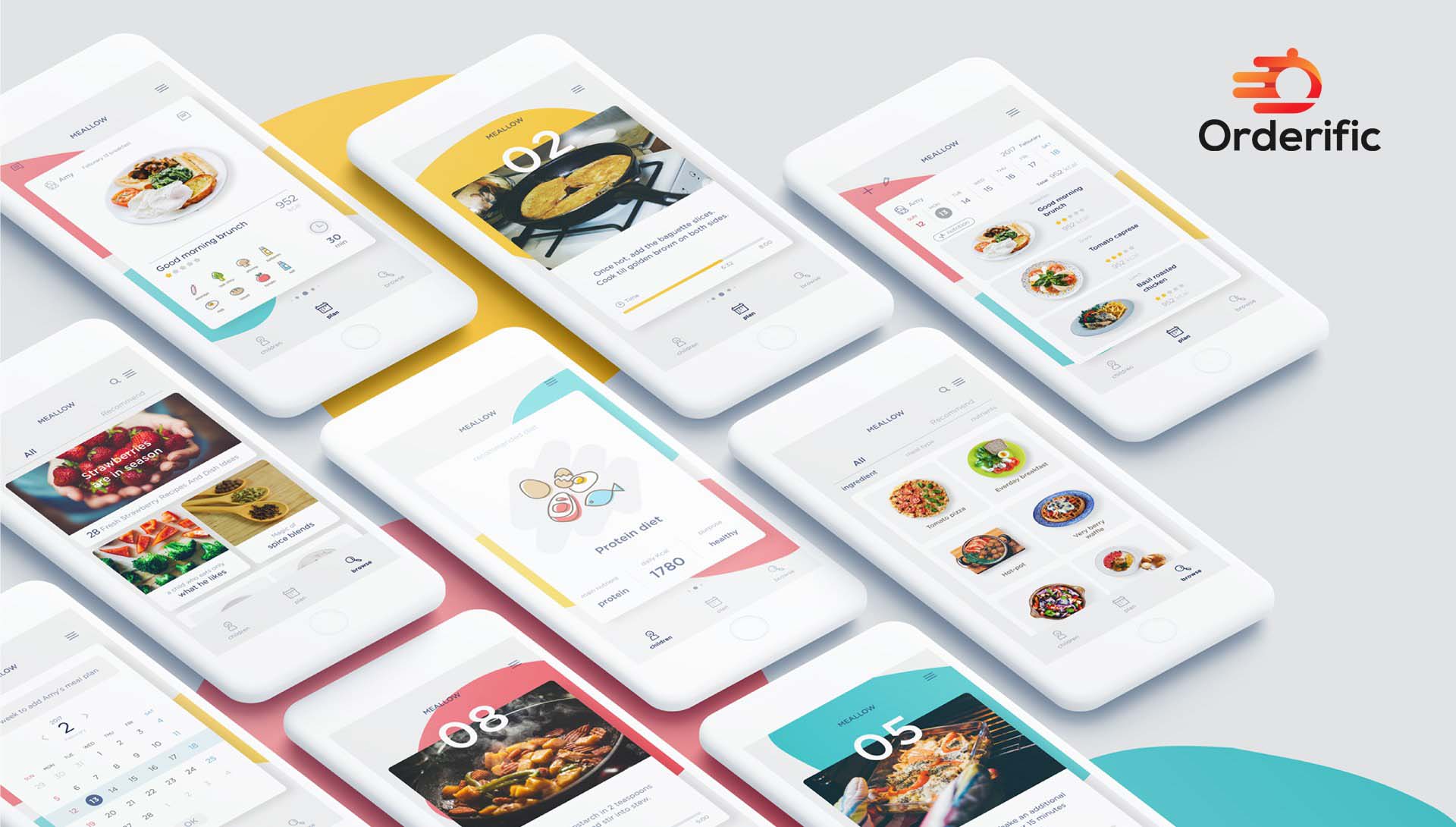

After reading this guide, if you’re an employer and would like help managing your payroll and ensuring compliance with both state and federal wage laws, we invite you to schedule a demo with Orderific. Our tools can help streamline your payroll process and keep you updated on minimum wage laws in real time. Schedule a demo now and let us assist you in creating a fair and compliant work environment.

FAQs

1. What is the current minimum wage in Massachusetts?

As of 2023, the minimum wage in Massachusetts is $15 per hour.

2. Has there been any recent increase in the minimum wage in Massachusetts?

Yes, the minimum wage increased to $15 per hour in January 2023.

3. What is the minimum wage for tipped employees in Massachusetts?

The rate for tipped employees in Massachusetts is $6.75 per hour in 2023.

4. Are there any exemptions to the minimum wage in Massachusetts?

Yes, some workers such as students, learners, and apprentices may be exempt.

5. How can an employee file a wage complaint in Massachusetts?

Employees can file a wage complaint by contacting the Fair Labor Division of the Massachusetts Department of Attorney General, either online or through a paper form.